Tracing the supply chain of EV’s: A Comprehensive Overview

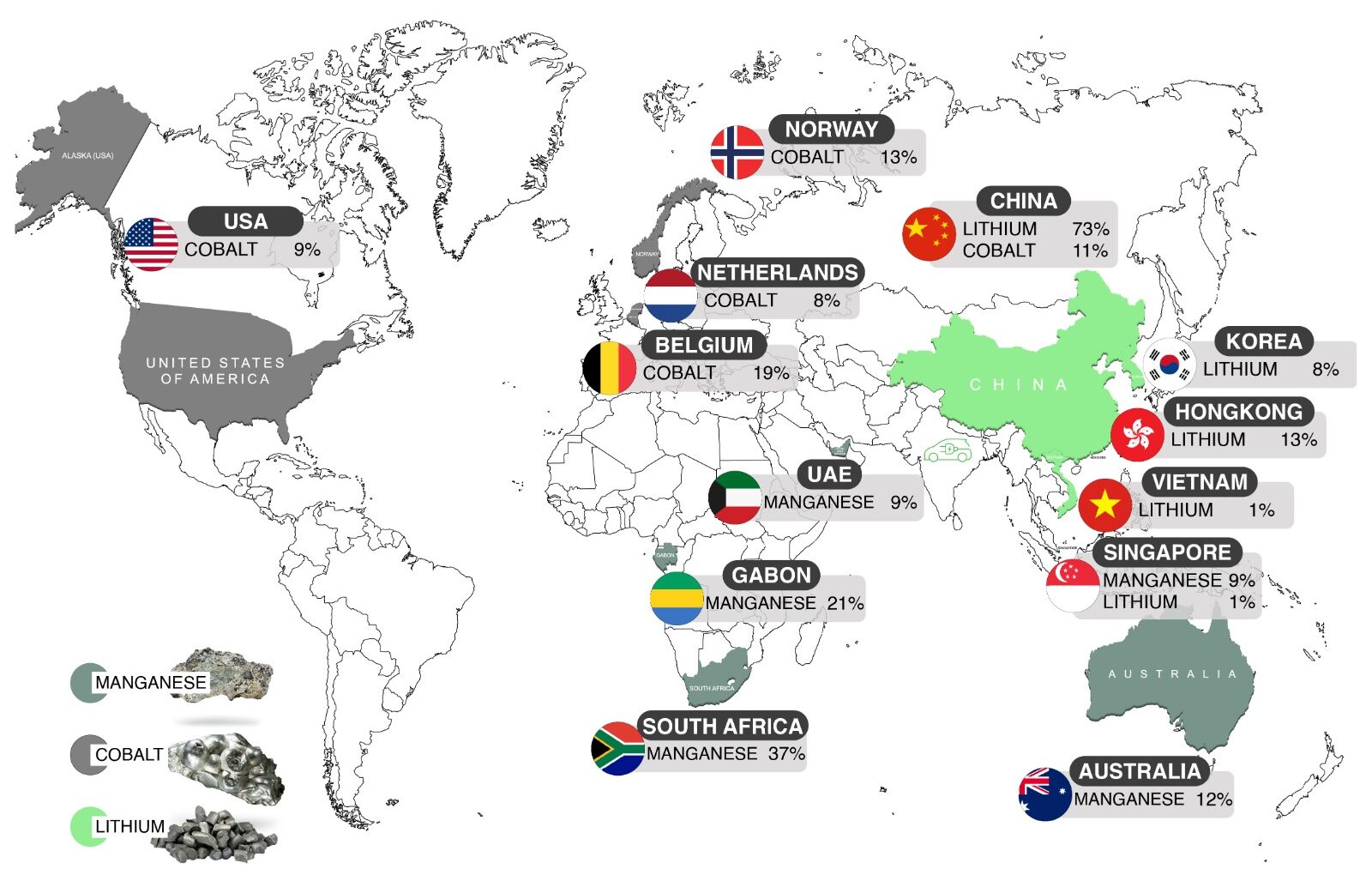

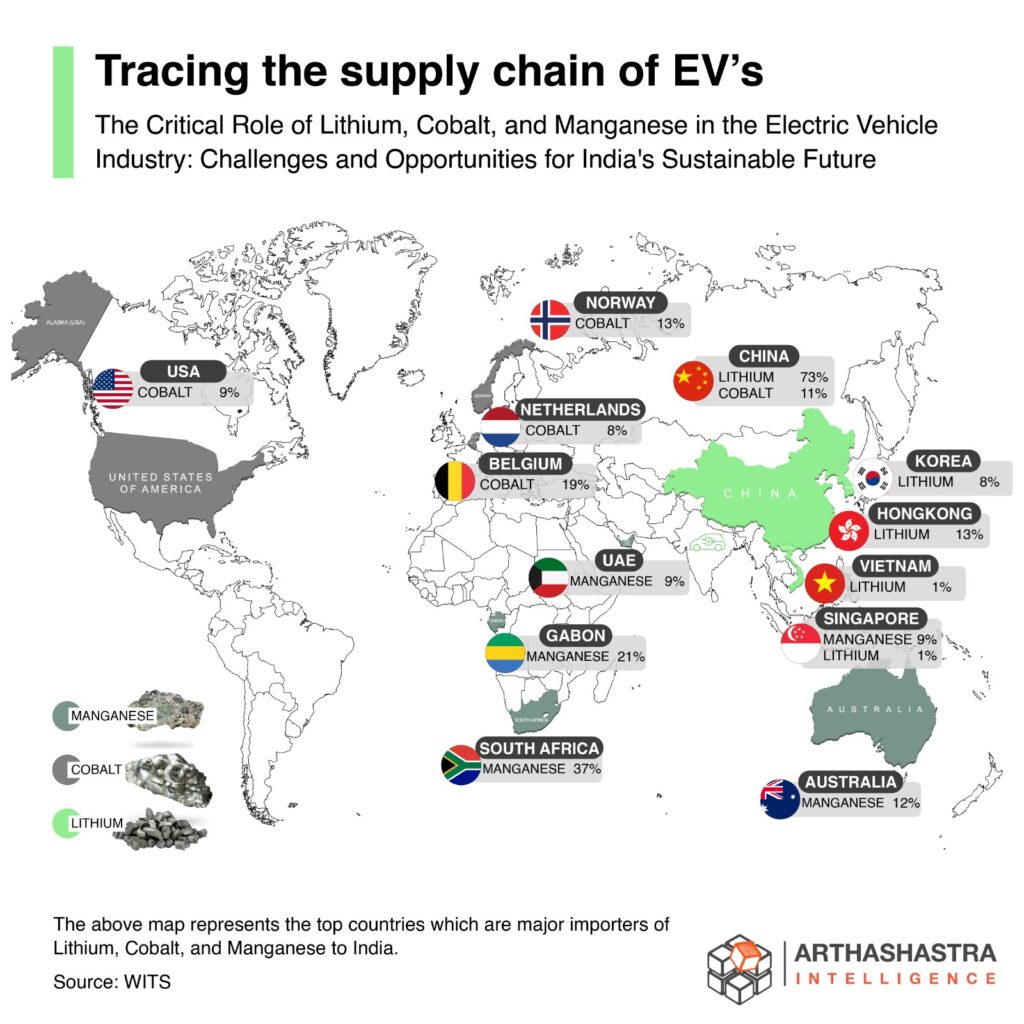

The above map represents the top countries which are major importers of Lithium, Cobalt, and Manganese to India.

Read ahead for the entire analysis and graph.

This blog post has been authored by Geetha Lagadapati, International Business Analyst at Arthashastra Intelligence

In recent years, the Electric vehicles industry has undergone a remarkable transformation, emerging as a pivotal force in the quest for sustainable and eco-friendly transportation. As the world transitions towards cleaner energy solutions, the dynamics of the EV industry, especially concerning key inputs like cobalt, Lithium, and Manganese, have become increasingly crucial. The Electric Vehicle industry, once a niche market, has now positioned itself at the forefront of the global automotive revolution. We’ve observed a rapid surge in the embrace of electric vehicles (EVs) across India. Notably, sales of electric two-wheelers have more despite demand, while electric 4 wheelers have doubled in FY22 compared to FY21. Despite supply chain challenges, original equipment manufacturers have significantly increased production to meet this growing demand. Customers, recognizing EVs as a modern and cost-effective commuting option with a lower total cost of ownership (TCO) compared to traditional internal combustion engine (ICE) vehicles, are increasingly embracing this shift.

Alternatives of EVs:

Hydrogen cars offer faster refueling times, range 400 miles from a single tank of fuel in contrast, and to the extended charging periods required for electric vehicles. This characteristic renders hydrogen vehicles well-suited for applications with energy constraints, such as long-haul trucks and airplanes. In these scenarios, where electric vehicles may face limitations in range and charging infrastructure, hydrogen cars present a more practical alternative. Biodiesel, Ethanol, Natural Gas, Propane, Renewable Diesel, and Sustainable Aviation Fuel can be the alternatives for EVs.

Powering the Future: The Role of Lithium, Cobalt, and Manganese in the Global Electric Vehicle Industry.

Central to the manufacturing of electric vehicles is the critical process of battery production, where the cathode and anode play pivotal roles. In this intricate system, the cathode, comprising approximately 50% of metals, assumes paramount importance, housing essential elements such as lithium, cobalt, manganese, and Nickel. Among these metals, Lithium stands out as the most crucial, given its central role in enhancing battery performance and efficiency. The global sourcing of Lithium is a nuanced landscape, with key player countries contributing to this essential supply chain. Notably, Australia emerges as a significant player, accounting for 52% of Lithium production. Other noteworthy contributors include Chile (25%), China (13%), and Argentina (6%). While it may seem counterintuitive that Australia, a major lithium producer, exports its Lithium to China, the dynamics of this trade are shaped by the intricate processing capabilities that China processes. Australia exports raw Lithium to China for processing, and it’s in this processing phase that China asserts its dominance in the lithium market. Remarkably, China is not only the largest consumer of lithium but also the principal exporter, commanding a staggering 60% share of global lithium exports. What sets China apart in the lithium landscape is its strategic establishment of processing units in nearly every lithium-supplying country globally. This astute move allows China to exert significant control over the lithium market, consolidating its position as the primary exporter of this critical metal worldwide. This strategic positioning underscores China’s influence in the electric vehicle supply chain, with the processing of lithium representing a crucial linchpin in the broader context of global sustainable transportation.

The largest producer of Cobalt with 72% is the Democratic Republic of Congo but China already started investing in those mines in Congo and has most of the operational units. So, even though Congo is the largest production unit of cobalt in the world, it is selling cobalt to China operational Units. So, however, China is the largest producer of these important metals which are used in the EV industry.

Environmental hazards of Mining:

Mineral extraction from nature poses numerous environmental and safety challenges, surface mining activities, including blasting, and hauling roads, generate dust, while coal mines release methane, a potent greenhouse gas. Inadequate safeguards in smelting operations contribute to air pollution, releasing heavy metals. The mining sector’s substantial water usage, though some mines practice reuse, raises concerns, as does the release of sulfide-containing minerals, forming sulphuric acid and impacting groundwater. The land suffers from rock displacement, especially in surface mines with overburden removal. Safety in mining operations varies, with underground mining presenting higher risks due to poor ventilation and visibility, as well as the potential for rockfalls. Health hazards include respiratory issues from dust and radiation exposure. Addressing these concerns is crucial to minimizing the adverse environmental and health effects associated with mining activities.

Description automatically generated Over the past few years, China has played a pivotal role, emerging as the primary supplier of lithium to India with an influential 72% ($1.8 billion) share. This signifies a significant reliance on Chinese resources to meet India’s increasing demand for lithium, as a key component in the production of batteries for electric vehicles and various electronic devices. Hongkong and Korea also contribute significantly, adding 13% ($0.34 billion) and 8% ($0.22 billion), respectively, to the lithium supply chain. Shifting to Cobalt, Belgium takes the stage as the top exporter to India, commanding a noteworthy 19% ($10.52 million) share. This highlights the global nature of India’s resource procurement, with European countries such as China, and Norway of 24% ($15.55 million) becoming crucial partners in supplying materials essential for advanced. Meanwhile, South Africa emerges as a leading contributor of manganese which is 37%. ($446.95 million) Gabon follows closely with a significant 21% ($257.52 million) and Australia contributes 12% (149.97 million).

As other countries charge up to meet the rising demand for electric vehicles, they will have to face China’s position as a leader in the Lithium-Ion battery economy. This rising demand for EVs has increased the demand for Lithium and its prices.

Are Lithium & Cobalt Replaceable?

These metals have unique features, we know that Lithium is the lightest metal in the solid state, and it has an energy efficiency of 95% where it can hold lots of energy which is 150-250 w-h/kg which is five times more than a normal battery. When it comes to Cobalt it enhances the energy density of lithium-ion batteries and it and more stability and longevity we can charge and discharge 1-2000x before their capacity starts decreasing, it enhances the safety of these batteries and prevents them from catching fire. So, Lithium and cobalt are irreplaceable.

Where does India stand in the EV revolution:

India needs to go electric because we need to meet our emission targets, otherwise, we are going to have a carbon tax which makes our products expensive in the global market. India doesn’t have any reserves, so we started importing Lithium-ion batteries worth 8800 crores from other countries but are mostly dependent on China (70%) to get the raw materials and some other countries. Recently mining officials identified the country’s first lithium reserve in Jammu and Kashmir and the second one is in Degana, Rajasthan which meets 80% demand for lithium. This discovery holds for lowering imports from China and ultimately makes EVs Affordable. In the beginning, manufacturing those vehicles had some big problems. Not many people wanted them, so companies couldn’t make a lot at once to make them cheaper because the batteries are expensive and very few people can afford them which leads to less demand.

The Indian government will join this revolution and they are planning to have 30% of private cars, 70% commercial vehicles, 40% of buses, and 80% of two-wheelers by 2030. The Indian EV industry is gathering momentum, supported by government initiatives and a rise in oil prices, and everyone will look for alternative sources to cut their monthly bills. Now there will be a mass shift from Ice to EVs which requires charging stations and other facilities and adapt everything by 2030.