The Transition: Exploring India's Rs. 2,000 Note Withdrawal and Clean Note Policy

This blog post has been authored by Shubhangini Singh, Economics Researcher at Arthashastra Intelligence

In a recent development, the Reserve Bank of India (RBI) has announced the withdrawal of the Rs. 2,000 denomination banknotes from circulation. The RBI has set a deadline of September 30, 2023, for the exchange of these notes. It’s important to note that the Rs. 2,000 notes will continue to be legal tender. This move is part of the Clean Note Policy, which aims to provide the public with good-quality currency notes and enhance security features. In this data story, we will delve into the reasons behind the withdrawal, the impact on the economy, and the significance of this decision.

Reasons for Withdrawing Rs. 2,000 Notes:

The Rs. 2,000 note was introduced in November 2016 under the RBI Act, 1934, as a replacement for the demonetized Rs. 500 and Rs. 1,000 notes. However, the printing of Rs. 2,000 notes was discontinued in 2018-2019. The initial plan was to give this denomination a lifespan of 4-5 years. Additionally, there is an ample stock of other denomination banknotes to meet the currency requirements. The withdrawal of the Rs. 2,000 notes aligns with the Clean Note Policy, which emphasizes the circulation of currency notes with enhanced security features.

Understanding the Clean Note Policy:

The Clean Note Policy, implemented by the RBI, aims to provide the public with high-quality currency notes and coins that incorporate advanced security features. As part of this policy, the RBI had previously withdrawn all banknotes issued prior to 2005. However, these notes continue to be legal tender, following the standard international practice of not having multiple series of notes in circulation simultaneously.

Is it actually demonetization?

It’s important to clarify that the Rs. 2,000 note will retain its status as legal tender, allowing the general public to use it for transactions and receive payments. However, individuals are encouraged to deposit or exchange these notes before September 30, 2023, at 19 RBI Regional Offices with Issue Departments. The exchange limit is set at Rs. 20,000 at a time without any restrictions, subject to compliance with Know Your Customer (KYC) norms and other applicable regulations.

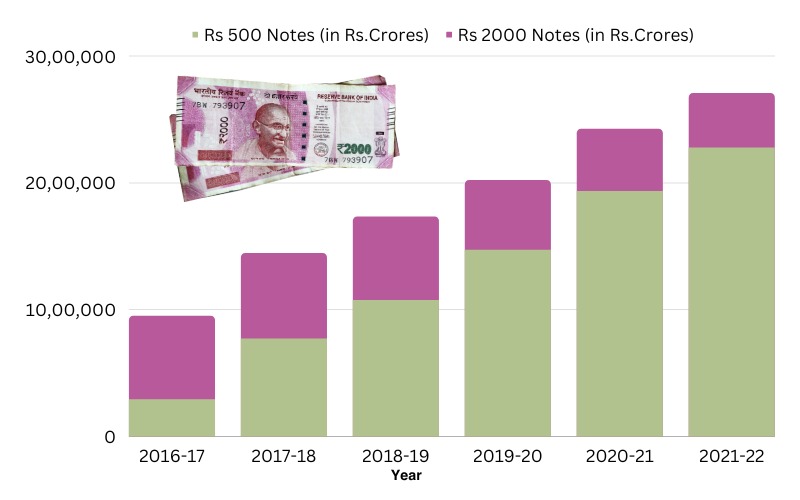

Valuing Currency in Circulation:

Around 89% of the Rs. 2,000 denomination banknotes were issued before March 2017, with an estimated lifespan of 4-5 years. As of March 31, 2023, the total value of these banknotes in circulation has declined to Rs. 3.62 lakh crore from the peak of Rs. 6.73 lakh crore observed on March 31, 2018. Currently, the Rs. 2,000 notes constitute only 10.8% of the total notes in circulation.

Source: Reserve Bank of India; Compilation and Visualization By Arthashastra Intelligence.

Demonetization as a Fight Against Counterfeiting:

In light of the withdrawal, the RBI has emphasized the importance of banks meticulously following its guidelines for handling counterfeit notes, especially if any counterfeit Rs. 2,000 notes are received. These notes must be immediately sorted for accuracy and genuineness using Note Sorting Machines (NSMs). The guidelines also outline the procedure for notifying the police in cases of counterfeit currency. The Nodal Bank Officer is required to provide a consolidated report to the police at the end of each month for transactions involving up to four counterfeit notes. For transactions with five or more counterfeit notes, the Nodal Bank Officer must promptly submit the counterfeit notes to the local police station for investigation and the filing of a First Information Report (FIR).

Effect on the Economy:

Governor Shaktikanta Das of the RBI remains optimistic about the minimal impact on the economy. However, if a large proportion of Rs. 2,000 notes are exchanged at bank counters, it could affect the velocity of money and potentially lead to immediate inflationary effects. Conversely, depositing a significant portion into bank accounts would strengthen the banks’ balance sheets, which is beneficial due to the current sluggish growth in deposits. As of now, the banking sector holds deposits worth 184.4 lakh crore. Therefore, converting all the Rs. 2,000 notes in circulation into bank deposits would result in a roughly 2% increase in overall bank deposits.

Conclusion:

The withdrawal of the Rs. 2,000 notes from circulation is a significant step towards enhancing the quality and security of currency notes in India. It aligns with the Clean Note Policy and aims to combat counterfeiting. While the impact on the economy is expected to be limited, careful monitoring of the velocity of money and inflationary trends will be essential. As individuals, it is advisable to exchange or deposit the Rs. 2,000 notes before the specified deadline to ensure smooth transactions and compliance with the Clean Note Policy. Let us embrace this change for a more secure and efficient monetary system.

References:

- Retrieved from Moneycontrol (Author: Moneycontrol): RBI Must Adopt Well-Defined and Time-Bound Guidelines on Replacing Soiled Notes.

- Retrieved from The Economic Times (Author: The Economic Times): Rs 2,000 Note Withdrawn from Circulation: If Bank Finds Your Note to be Fake, This is What Will Happen.

- Retrieved from The Indian Express (Author: The Indian Express): Why has the RBI Withdrawn the ₹2,000 Notes?

- Retrieved from Business Today (Author: Business Today): Bank Notes in ₹2,000 Denomination Will Continue to Be Legal Tender: RBI Issues FAQs.

- Retrieved from The Hindu Business Line (Author: The Hindu Business Line): RBI Announces Withdrawal of ₹2,000 Currency Notes, Legal Tender until September 30.