Deciphering India-Sri Lanka Relations: Neighbourhood first?

This post has been authored by Shwetha Vincent and Anjan Kumar, Research Analyst Interns at Arthashastra Intelligence

The recent investment into the East Terminal of Colombo Port by Adani Ports and Special Economic Zone Ltd brings up a common question,”How critical is India’s Neighbourhood First Policy in the current geo-political climate?”. India’s substantial interests in Sri Lanka have been political, economic- or a combination of both. India’s economic relationship with its neighbour is rooted in its “Neighbourhood First” Policy. The Indian government has supplied concessional funding approximating $2 billion to a variety of sectors in Sri Lanka. Around $139 million worth of FDI was invested in Sri Lanka in 2019. India also made a Free Trade deal in March 2000. This deal benefitted 60% of Indian exports. India- Sri Lanka relations are of particular importance during these turbulent times. The Covid-19 pandemic particularly affected the tourism sector in the Sri Lankan economy. The tourism-dependent economy of Sri Lanka struck the financial health of the country. Foreign revenues were down by around $450 million a month after the pandemic, and there is an increase in the Consumer Price Index (6.7% as of August 2021). As Sri Lanka’s foreign currency reserves dried up, the country entered a state of economic emergency. Its precarious position was exacerbated by its large amount of debt. While Sri Lanka was able to pay a $1 billion loan payment, it did so at the cost of its foreign exchange reserves. As India’s neighbour entered a state of economic emergency, Indian support to Sri Lanka began to wane.

In July 2020, the Reserve Bank of India and the Central bank of Sri Lanka signed a currency swap deal under SAARC Currency Swap Framework for a withdrawal of $400 million. This swap was supposed to be valid until November 2022. The Central Bank of Sri Lanka settled the deal in February 2021. India, conversely, did not renew the deal, and cited the absence of an International Monetary Fund program to address the economic imbalances in the Sri Lankan economy. Furthermore, In 2012, the Sri Lankan economy faced crisis as the service sector slowed and inflation increased. Droughts and floods adversely impacted agriculture. The situation was worsened with the reduction of current expenditure to meet the budget deficit. The straw that broke the camel’s back was the depreciation of the Sri Lankan rupee. There is a gradual decline in the imports that Sri Lanka received from India from 2017-18, resulting in a trade deficit. The rise in the deficit can be observed first in 2011-12. After which there was a decline for four years (2013-17), but didn\’t last longer. If the trade deficit lowers to a particular point, India will lose its influence over Sri Lanka.

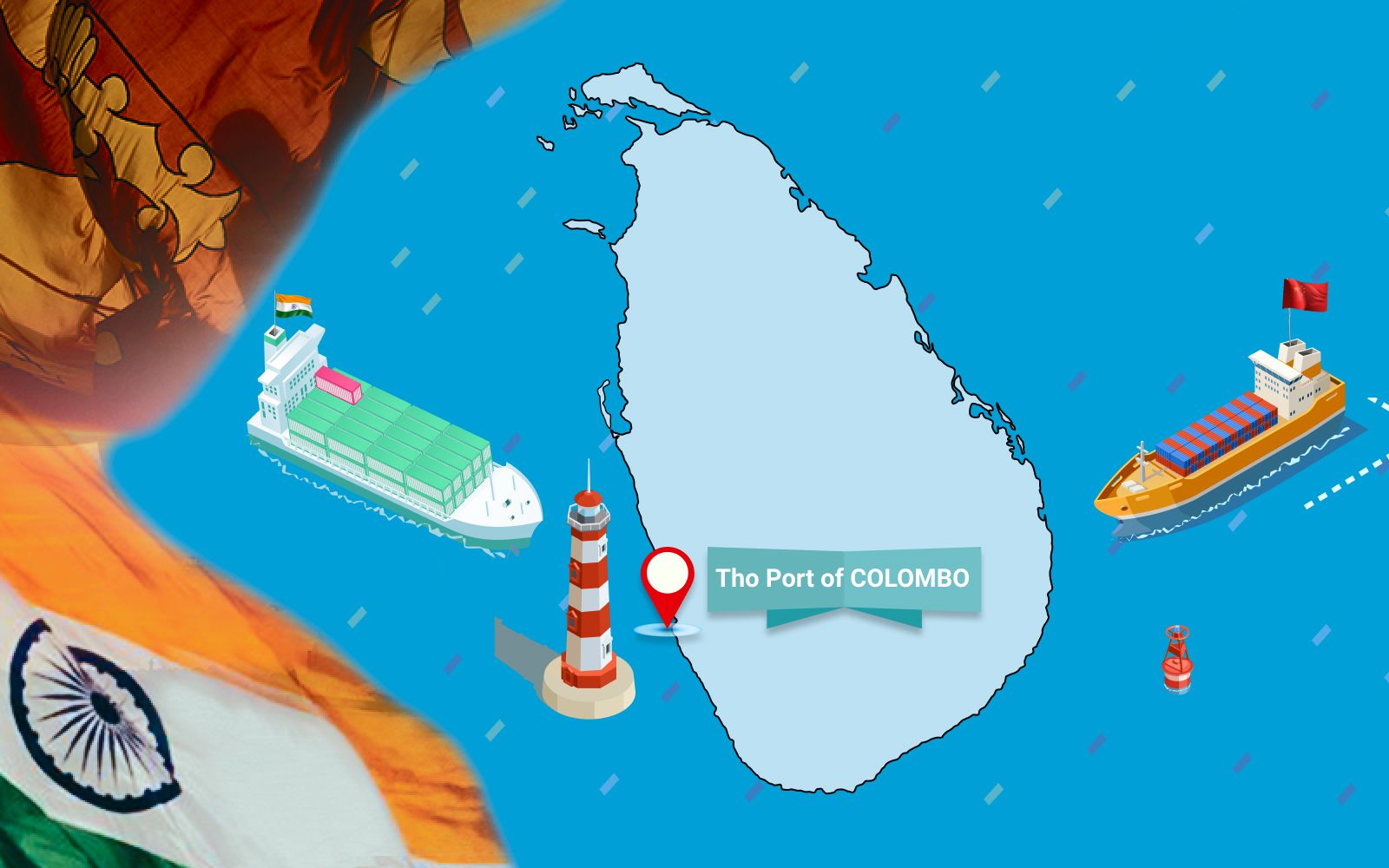

As economic relations between India and Sri Lanka went downhill, Sri Lanka’s dependence on Chinese funding grew. Sri Lanka with its external debt to Gross National Income being 68.75% has sought a loan ($1.3 billion) and a currency swap deal ($1.5 billion in March 2020) from China to ease its reserve troubles. This shift in Sri Lanka’s relations is prevalent among other South Asian nations as well, particularly Bangladesh and Maldives. Sri Lankan relations under the “Neighborhood First” Policy is important for India because it increases the scope of trade and commerce along the Indian Ocean region. The port of Colombo controls around 60% of India’s cargo, and hence, is of significant importance. It follows that the solidification of Chinese influence in Colombo port city with a 99-year lease pact (as similar as Hambantota port deal)5 is alarming to India.

For the first time in 2020 Sri Lanka\’s exports to China surpassed those to India. To counter, India has renewed its neighbourhood policy to consolidate its influence and interest in the Indian Ocean. India has deep political and economic ties with Sri Lanka through providing agricultural fertilisers, food security, and intellectual strategic frameworks. It should move forward with caution in order to preserve its national and strategic interest in the region.

References:

1. The World Bank- Country Report, Sri Lanka:

https://www.worldbank.org/en/country/srilanka

2. CEIC Data- Sri Lanka Total Loans- Economic Indicators:

https://www.ceicdata.com/en/country/sri-lanka

3. Observer Research Foundation- “Charting a New Trajectory in India-Sri Lanka Relations” by Vijay Sappani:

https://www.orfonline.org/expert-speak/charting-a-new-trajectory-in-india-sri-lanka-relations/?amp

4. Business Standard- “Sri Lanka\’s storm in a teacup may compel India to bring out its checkbook\” by Andy Mukherjee:

5. India Today- “Revival of Hambantota port in Sri Lanka may strengthen China’s position in Indian Ocean” by SaiKiran Kannan: