Repo Rate Variations in Emerging and Advanced Economies: A Comparative Analysis

This blog post has been authored by Shubhangini Singh, Economics Researcher at Arthashastra Intelligence

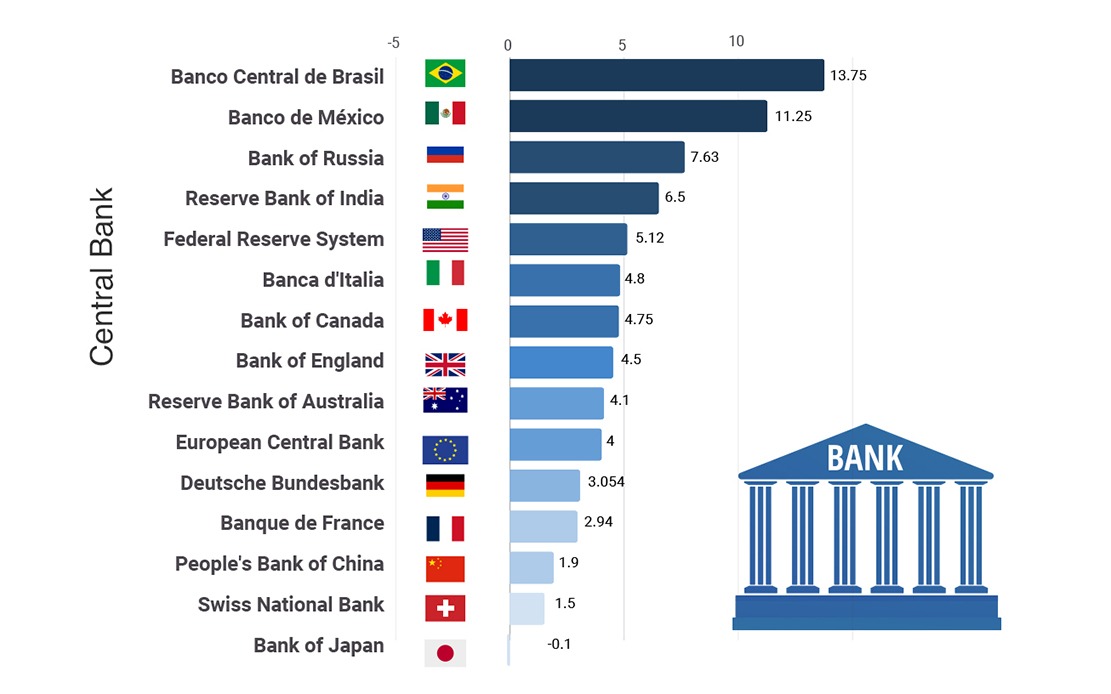

Repo rates play a crucial role in shaping a nation’s monetary policy and economic conditions. They reflect the interest rates at which central banks lend money to commercial banks against collateral. By analyzing repo rates in different nations, we can gain insights into their monetary policies, inflationary pressures, and economic stability. In this article, we will explore the repo rates of both developing and developed nations, highlight major findings and comparisons, and discuss the factors influencing repo rates in various economies.

Repo Rates in Developing Nations:

Developing nations often exhibit higher repo rates compared to developed nations. This disparity suggests that developing nations typically have higher interest rates to control inflation, stabilize their economies, or attract investments. For instance:

- China stands out among developing nations with a repo rate of 1.90%, which is relatively lower than other developing nations. This reflects China’s efforts to balance economic growth and inflation control.

- Brazil and Mexico have significantly higher repo rates compared to developed nations. This indicates that these countries might be facing higher inflationary pressures or have different monetary policy objectives.

Repo Rates in Developed Nations:

On the other hand, developed nations generally have lower repo rates, which signifies a focus on stimulating economic growth or addressing low inflationary pressures. Here are some notable repo rates in developed nations:

- The United States Federal Reserve System sets its repo rate at 5.12%, indicating its approach to maintaining a balanced economic environment.

- The European Central Bank (Eurozone) maintains a main refinancing rate of 4% to regulate liquidity in the Eurozone.

- Japan has the lowest repo rate at 0.1%, reflecting the country’s struggle with deflation and the need for an accommodative monetary policy to encourage spending and investment.

Comparisons and Insights:

By comparing repo rates across nations, we can observe interesting patterns and draw insights.

Source: Central Banks; Compilation and Visualization By Arthashastra Intelligence.

For example:

- Developing nations like Brazil and Mexico have significantly higher repo rates compared to both developed and other developing nations. This suggests that these countries may be facing higher inflationary pressures or have unique economic challenges.

- China’s relatively lower repo rate among developing nations indicates its efforts to balance economic growth and inflation control, showcasing its unique economic circumstances.

- Japan’s extremely low repo rate highlights the country’s long-standing struggle with deflation and the need for an accommodative monetary policy to stimulate economic activity.

Factors Influencing Repo Rates:

The factors influencing repo rates vary across nations and depend on their economic conditions and policy objectives. Here are some examples:

- In the United States, the federal funds rate, which influences repo rates, is determined by market forces and the supply and demand of funds between banks. The Federal Reserve System does not directly set the rate.

- The European Central Bank’s control of money market rates is influenced by official rates, excess liquidity, and government yields in different jurisdictions.

- The Bank of England sets the repo rate, also known as the base rate, which influences borrowing costs for commercial banks. It plays a crucial role in determining saving and borrowing rates throughout the economy.

- In China, interest rates are a mix of market-determined rates and regulated rates, reflecting the country’s gradual process of interest rate liberalization.

Conclusion:

Analyzing repo rates across nations provides valuable insights into their monetary policies, inflationary pressures, and economic stability. Developing nations generally exhibit higher repo rates, while developed nations tend to have lower repo rates to stimulate economic growth. Unique economic circumstances and policy objectives influence repo rates in different nations. By understanding these variations, we can gain a deeper understanding of the global economic landscape.

References:

Retrieved from St. Louis Fed (Author: St. Louis Fed): “How Does the Fed Use Its Monetary Policy Tools to Influence the Economy?“

Retrieved from Federal Reserve (Author: Federal Reserve): “The Fed Explained“

Retrieved from Bruegel (Author: Bruegel): “Can the European Central Bank Control Interest Rates?“

Retrieved from Economics Help (Author: Economics Help): “How the Bank of England Sets Interest Rates”

Retrieved from ScienceDirect (Author: ScienceDirect): “Central bank interest rate setting: institutional framework and empirical results”

Retrieved from Bank for International Settlements (Author: Bank for International Settlements): “Monetary Policy Frameworks in EMEs: The Case of Brazil”

Retrieved from LiveMint (Author: LiveMint): “What Could Be the Reason for RBI’s Early Pause in Repo Rate When Inflation Is Still High?”