Redefining Money: Exploring the Rise and Impact of Central Bank Digital Currencies

This blog post has been authored by Shubhangini Singh, Economics Researcher at Arthashastra Intelligence

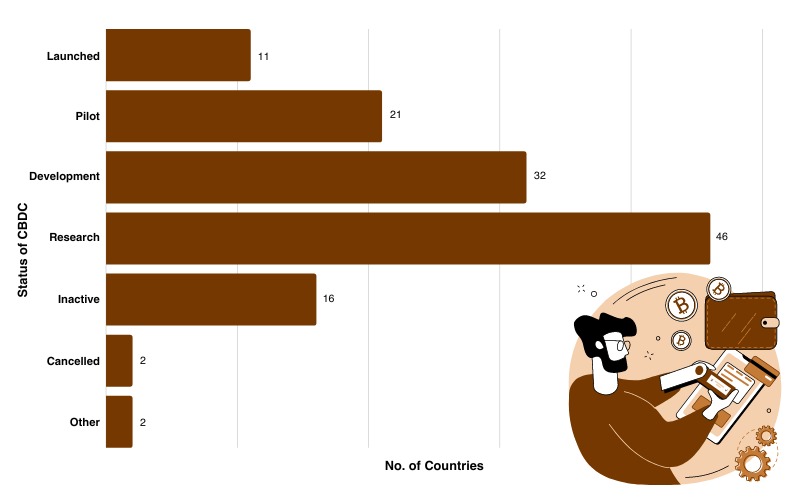

The history of money has transformed from metal coins to digital transactions, and now, it’s taking another revolutionary step with the emergence of Central Bank Digital Currencies (CBDCs). As of now, nearly 90% of the world’s central banks are actively exploring or developing CBDCs, signifying a substantial shift in the financial landscape. CBDCs, as digital forms of currency issued by central banks, offer a unique blend of convenience, security, and policy control. These currencies are poised to redefine the way we transact, save, and interact with money, leading to a fundamental transformation in the global financial ecosystem.

Types of CBDCs

CBDCs come in two primary types based on usage:

Wholesale CBDC: This variant is designed to cater to the needs of financial institutions. It streamlines inter-bank transactions, promising enhanced efficiency and accuracy. Additionally, cross-border transactions, often plagued by delays and uncertainties, could see a substantial improvement with the integration of wholesale CBDCs.

Retail CBDC: Tailored for individuals, retail CBDCs hold the potential to transform the way people engage with money on a daily basis. Individuals would have access to digital cash backed by their country’s central bank, providing a secure, state-backed alternative to traditional currency. Moreover, it could accelerate the transition towards a cashless society.

CBDCs in India

India has emerged as a trailblazer in the CBDC landscape, making significant strides in embracing this technological advancement. The introduction of Wholesale CBDC on November 1st and Retail CBDC on December 1st underscores India’s commitment to staying ahead in the digital currency revolution. The Reserve Bank of India (RBI) has identified major banks like SBI, HDFC, and ICICI to participate in the pilot project of Wholesale CBDC, demonstrating the collaboration between the central bank and financial institutions.

The digital rupee, an ambitious project by the RBI, serves a dual purpose. It aims to boost the efficiency of payment systems, addressing the need for faster and more reliable transactions. Simultaneously, it strives to offer a risk-free digital currency that shields the public from the inherent volatility associated with cryptocurrencies. However, the successful implementation of the digital rupee hinges on a meticulous approach to cybersecurity, ensuring that the digital infrastructure remains resilient against potential threats.

Source: Atlantic Council of United States; Compilation and Visualization By Arthashastra Intelligence.

The Motivation and Problem Solving

The inception of CBDCs addresses some of the persistent challenges in the traditional monetary system:

- Mitigating Bank Runs: CBDCs, functioning similarly to physical cash, are under the direct purview of the central bank. This design ensures that CBDCs are a safer form of digital money compared to those issued by commercial banks, reducing the risk of bank runs during financial crises.

- Redefining Cash and Bank Deposits: CBDCs could fundamentally alter the dynamics of cash deposits and lending activities. Central banks would replace private banks as the primary source of funding for lending activities, reshaping the financial landscape and reducing the dependency on private bank deposits.

- Streamlining Regulation and Inclusion: CBDCs offer robust regulatory oversight by enabling better detection of criminal activities. Additionally, CBDCs have the potential to bridge financial inclusion gaps by allowing transactions without the need for a traditional bank account.

- Cost Efficiency and Infrastructure: The introduction of CBDCs could eliminate the need for extensive physical infrastructure for cash transactions, leading to potential cost savings for both financial institutions and individuals.

Design and Technology of CBDC

CBDC design models can be categorized into three types:

- Direct Model: This model places the central bank at the forefront of managing all aspects of the CBDC system, including deposits and transactions. While it offers centralized control, concerns arise regarding the extent of private sector involvement and the potential burden on the central bank.

- Indirect Model: Indirect models involve intermediaries through which CBDCs are issued to consumers. Consumers hold CBDCs in intermediary accounts, while the central bank oversees the wholesale balance of these intermediaries.

- Hybrid Model: The hybrid model strikes a balance between direct and indirect approaches. Central banks and private institutions are authorized to issue CBDCs. Central banks issue the CBDCs, which are then provided to intermediaries, leveraging the strengths of both sectors.

The technology considerations of CBDCs encompass scalability, security, cross-platform compatibility, and fraud prevention. The retail digital rupee’s distribution mechanism involves banks managing distribution and payment services, with the RBI overseeing issuance and redemption.

Policy Considerations and Cross-Border Payments

Offline capability is a critical consideration for CBDCs, particularly in regions with limited internet access, ensuring that a broader population can engage with digital currencies. Additionally, data analytics from CBDC transactions could yield valuable insights for evidence-based policy development and better regulatory compliance.

Global Impact and Future Considerations

CBDCs hold immense potential for revolutionizing cross-border payments, addressing long-standing inefficiencies and reducing transaction costs. However, challenges related to capital flow controls and currency substitution need to be carefully navigated.

CBDC Effects on Monetary Policy and Central Bank Operations

CBDC issuance has far-reaching implications for monetary policy and financial stability. The concept of the CBDC trilemma highlights the challenges central banks face in balancing efficiency, stability, and price control. Striking the right balance will be critical to the successful implementation of CBDCs.

Exploring the Potential of CBDCs in India

India’s proactive approach to CBDCs is evident in its pilot program, which showcases the potential of CBDCs in various sectors. From G-Sec market settlements to personal and business transactions, the digital rupee promises to enhance financial operations while maintaining security and efficiency.

Conclusion

The evolution of money is reaching a pivotal juncture with the emergence of CBDCs. These digital currencies, backed by central banks, offer a novel blend of innovation, security, and policy control. As central banks across the world continue their journey towards CBDC adoption, the financial landscape is undergoing a profound transformation. While challenges persist, the potential for enhanced efficiency, financial inclusion, and global connectivity is poised to redefine the way we perceive and utilize money.

References:

- Retrieved from the University of Chicago (Author: Linda Schilling, Jesús Fernández-Villaverde, and Harald Uhlig): “Central Bank Digital Currency: When Price and Bank Stability Collide”

- Retrieved from SUERF (Author: Wim Boonstra): “Central bank digital currency: institutional issues“

- Retrieved from the Reserve Bank of India (Author: The Reserve Bank of India): “Concept Note on Central Bank Digital Currency”

- Retrieved from Bank of Canada (Author: Mohammad Davoodalhosseini, Francisco Rivadeneyra, and Yu Zhu): “CBDC and Monetary Policy”

- Retrieved from the Bank for International Settlements (Author: Bank for International Settlements): “Committee on Payments and Market Infrastructures”

- Retrieved from the Bank for International Settlements (Author: Bank for International Settlements): “Central bank digital currencies for cross-border payments“

- Retrieved from SUERF (Author: Christian Pfister): “Retail CBDC Remuneration: The Sign Matters“